Prytania Quarterly Update - April 2024

- abhalla75

- Apr 25, 2024

- 13 min read

Collateralized Loan Obligations (CLOs)

Introduction

This quarterly update will explore developments in CLOs, a market which has evolved and grown significantly since the GFC. A brief introduction to the asset class is followed by a summary of recent trends in the market and an outline of where we see the current value proposition. This is followed by and overview of the drivers of risk and return, including key factors which differentiate the European and US markets.

Collateralized Loan Obligations

A collateralized loan obligation (CLO) is a financial security that is backed by a diversified pool of collateral, typically consisting of more than 100 senior and mezzanine debt loans that are either secured or unsecured. There are two main types of CLOs: those backed by broadly syndicated loans (BSL), and those backed by middle market (MM) loans which are typically underwritten to smaller corporates with less than $150-250m facility sizes.

A CLO is structured with multiple debt tranches, usually AAA to BB, and an equity tranche; the seniority of the tranche represents the level of risk and returns associated with the investment. For example, AAA investors would benefit from having first lien on cashflows but would also be offered the lowest spread over SOFR/EURIBOR on their investment. In contrast, equity holders benefit from uncapped returns accruing from any excess cashflows generated by the CLO while being the first to experience any losses from defaults in the underlying collateral. They also have a degree of control that the debt holders do not have, in light of the higher risk, with regard to decisions of refinancing or resetting the investment.

Chart 1: CLO Capital Structure

Recent Trends and Current Opportunity

In 2022, global structured credit markets, in common with traditional assets, experienced significant dislocation, with credit spreads in the primary and secondary market surging rapidly. Notably, Europe saw materially more widening than in the US. Spreads on European AAA and AA rated broadly syndicated collateralized loan obligations (BSL CLOs), for example, neared the levels seen after the Global Financial Crisis (GFC), and nearly reached the short spike seen in the immediate aftermath of COVID-19. The spread widening on comparable US BSL CLOs, albeit still significant, was more muted. Whilst spreads have since experienced tightening from their near historic highs, with this momentum accelerating in Q4 2023 and in Q1 2024, CLOs still offer compelling headline yields and cash coupons. Most recently, yields on seasoned US AAA BSL CLOs stand at c. 5.8% over a 4 year WAL, with the higher upfront forward curve currently offer a c. 6.75% cash coupon. Further down the capital stack, when compared against similarly rated BB corporate bond risk (ICE BB US High Yield, April 2024) at 6.41%, CLOs still offer a considerable excess return at a 7.9% yield.

Chart 2: Total Yield: AA & BB EU BSL CLOs

Source: Wells Fargo Data, CLO Spreads, 1st January 2011 to 10th April 2024

Data shown is for CLO 1.0 from 1st January 2011 till 22nd February, 2013, and thereafter for CLO 2.0

Chart 3: Spread Differential: EU BB CLO Spreads vs HY Bond Spreads

Source: JP Morgan Data, CLO Spreads, 31st December 2020 to 10th April 2024

Chart 4: Total Yield: AA & BB US BSL CLOs

Source: Wells Fargo Data, CLO Spreads, 1st January 2011 to 10th April 2024

The chart is created using LIBOR swap rates from 1st January 2011 till 30th June 2023 and thereafter using SOFR swap rates.

Chart 5: Spread Differential: US BB CLO Spreads vs HY Bond Spreads

Source: JP Morgan Data, CLO Spreads, 31st December 2020 to 10th April 2024

We have been positive on the senior end of the capital structure for quite some time. Rising benchmark rates and relatively wide credit spreads have created a total return profile that we still believe is compelling today without taking a high degree of credit risk. In fact, we believe investment grade structured credit offers an asymmetric risk-return profile. The bond profiles that we favor, using conservative modelling and assumptions, can withstand enormous stresses and high defaults before the principal of the senior tranche is at risk of being impaired. Additionally, many senior structured credit tranches can benefit from additional protection from the collateral and liability tests/triggers embedded in the deal documentation. We also find compelling opportunities in certain, selective non-IG CLO bonds.

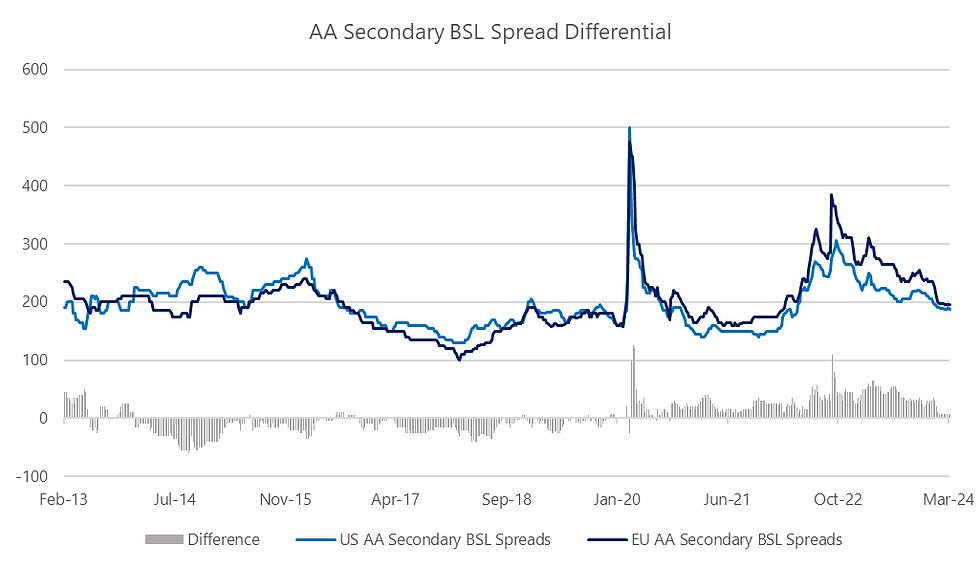

Chart 6: Spread differential between AA European BSL CLOs and AA US European CLOs

Source: Wells Fargo, CLO Spreads, 22nd February 2013 to 22nd March 2024

As shown in the chart above, for a period of time since the pandemic, European AA CLO spreads were significantly wider than equivalent US AAs. To contextualize the dislocation in Europe, credit spreads for European AA rated BSL CLOs reached levels that were 4.5 standard deviations from their long run mean during the UK pensions/LDI crisis in September and October 2022. Whilst the U.S. economy was stronger than those in Europe at the time, we deemed the market risk premium as more than sufficient compensation, viewing the risk adjusted returns as more compelling in Europe. As regional fears over Europe abated, the market subsequently followed this view with the basis tightening significantly since the summer of 2023. Following this tightening and the subsequent reduction of the premia on offer, we now see a higher preference for US paper given the stronger underlying fundamentals in the US economy.

Factors driving the dichotomy between Europe and the US

Possible explanations for the differentials between Europe and the US would include both fundamental factors and technical nuances One key factor is the evaluation of liquidity between both markets. The US BSL CLO market is significantly larger compared to Europe, recently breaching the $1 trillion mark, with the European market standing at $250bn. While on a comparative basis the European CLO market is less developed, and does not have as high a degree of market depth and efficiency, it should be noted that both markets have met a critical threshold that enables robust liquidity comparatively as a sub-asset class within the wider structured credit universe. A key test on liquidity in the European market was the reaction to the UK pensions/LDI crisis which saw pension funds racing for liquidity to meet margin calls on their highly levered Gilt positions. During this period, the European CLO market saw substantial secondary volumes at €2.5bn over a period of 1 week. This was c. 8-fold the usual weekly volume, thus highlighting the market’s ability to sufficiently function during peak times of stress and absorb high volumes of paper. Overall, the growth of both US and European markets since the GFC has enabled robust liquidity, although during times of volatility, bonds further down the capital stack and from less liked managers can suffer from scarcer liquidity.

The onslaught of post GFC regulation, which has had a significant effect on global structured credit markets, has been more punitive and restrictive in Europe. CLOs are a prime example of that, as Europe, for example, still has Risk Retention rules in place. The requirement for such dedicated Risk Retention capital is constraining the supply of new CLOs and, thereby, hindering the expansion of the market. This is in stark contrast to the US CLO market, which abolished Risk Retention requirements in 2018.

Market volatility in European and US CLOs can often stem from regional specific macro factors. This has been more acute recently in Europe, where spreads on structured credit products experienced greater widening due to proximity to the Russia-Ukraine war and the UK pension/LDI crisis of 2022. Related factors include Europe’s energy crisis along with stubbornly high and persistent inflation in the UK. The news flow pertaining to Europe and the UK was continuously pessimistic and depressed sentiment to a greater degree than justified by the contemporaneous date. We are starting to see a change in sentiment as extremely adverse scenarios, once plausible to the consensus, now appear less likely. The easing of these concerns has been a prime factor behind the aforementioned tightening in the basis between European and US spreads.

Another key consideration on European versus US CLOs is that their collateral will naturally diverge in accordance to the characteristics of their respective underlying loan markets. On the distribution of loan ratings, European CLOs tend to have a high focus around single ‘B’ rated names, 44% (EUR) vs. 26% in US (S&P, Q4 2023). US CLOs have more upended tails on both sides of the risk spectrum: ‘BB-‘ and above, 23% vs. 11% EUR; ‘CCC’ and below, 7.5% vs. 5.0% EUR. The Weighted Average Rating Factor (WARF), a proxy of overall risk on a CLO’s underlying pool, indicates riskier overall portfolios for European CLOs at 2917 vs. 2779 in the US (Morgan Stanley, Q1 2024). On diversity, US CLOs have a higher breadth of underlying obligors that typically broaden out to more industries, whilst European CLOs have a higher regional diversity. Due to regulatory divergence on CLO’s ability to invest in bonds, where the US authorities restricts investment to 5%, European CLOs have significantly higher exposure, most recently at 15.6% (Morgan Stanley, Q1 2024) vs. 2.0% in US. Moreover, there has been an increasing trend for European CLOs to utilize their bond buckets, which has been gradually increasing since 2022, where the range prior to then was typically 7.5%-10%. This has been a largely technical driven event due to a reduction in the supply of leveraged loans; a function of reduced M&A activity. Also, given the significant portion of bonds that are fixed rate, it also represents managers’ increased willingness to take on duration risk as capital structures often show a mis-match between assets and liabilities. Whilst some metrics may point to a higher risk profile on European CLOs, they typically benefit from larger structural subordination and thus a higher cushion against any potential defaults. As an example, credit enhancement offered on ‘BB-‘ tranches in European CLOs are on average 2 points higher compared to similarly rated US CLOs.

Our view on CLO equity

We have been relatively bearish on CLO equity for some time and had sold most of our positions. This was not just a view on the tightness of the arbitrage that tends to dominate market dialogue. While headline returns might appear attractive, we believe that on a risk-adjusted basis, investor outcomes will be less compelling due to high volatility. On a risk-adjusted basis, we expect the best performing deals might be able to achieve high single/low double-digit returns, while underperforming deals may see low or even negative IRRs. In our opinion, many of the equity bonds we see remain highly overvalued at prevailing prices.

Aside from the widely expected and observed uptick in defaults or restructurings, and the prospect of lower recoveries, we have argued that the market is also underpricing downgrade risk. This could cause equity and other junior debt classes to see their cashflows shut off (for debt, the coupon switches to pay-in-kind (PIK), which means that they would have to capitalize interest payments). These scenarios are likely to translate into sharp and violent downward moves in prices in the bonds at risk. While a widespread ‘credit crisis’ has not appeared to be a base case scenario, the chances of trigger events causing more severe damage to the borrowers was sufficiently worrying to suggest investors were better placed to own the safer debt tranches. With the tightening by leading central banks exceeding even our bearish forecasts, owners of CLO debt benefitted from rising (and high by historical standards) coupons that reached levels usually only achievable by owning the first loss tranches.

Factors determining value in CLOs

The following outlines Prytania’s thought process on some of the factors that need to be taken into consideration to assess the drivers of risk and return, with reference to how we systematically approach them as part of our investment process:

Sectoral and Regional Focus: Through a top-down evaluation of the structured credit universe, we assess each region and sector on the current fundamental scenario and risk-return profile to develop a view on which segments of the market are over or undervalued. This top-level view is informed through careful due diligence, leveraging in-depth market research and extensive experience through multiple cycles.

Primary versus Secondary Market Opportunities: Another key aspect of consideration is the opportunity set between primary and secondary markets. Generally, in primary markets higher rated CLO bonds are issued at par, but further down the capital stack some original issue discount is more common. In contrast, the secondary market can offer bonds at a more meaningful discount, thus enabling greater upside potential through capital appreciation. Purchasing in primary at par has limited upside, as appreciation above par tends to be more tempered. This is often due to an increased likelihood of a call being exercised as the deal seasons. To enable a clear view on the potential capital appreciation from discounted opportunities, it is crucial to understand the vector of call likelihood over time. This also includes the appropriate pricing of extension risk; when a deal runs longer than expected. A clear view on ‘callability’ is achieved through a comprehensive understanding of how a deal is structured and documented, the collateral profile, manager behavior and the incentive structures of stakeholders’ underlying economic interests.

Liquidity: The CLO market has seen a steady growth in overall market size, with a solid and diverse investor base being established. Whilst this has promoted overall market liquidity, this is heterogeneous when evaluating across the universe of CLO managers. Therefore, when considering returns, it is important to consider an appropriate liquidity risk premium. There are both qualitative and data driven approaches to evaluate liquidity. On the data side, Prytania has developed proprietary technology that can provide market insight on the bid-ask spread at an individual asset level, aggregating on a sectoral basis to identify key trends and reactions to shocks. When data is scare, there are times when a more qualitative approach should be taken; an example being new issue managers. A small stream of new managers enter the market on a semi-regular basis (dependent on market conditions), which given the scarce trading history, results in a natural liquidity premium. Such cases can open up opportunities to benefit from a spread pick up, which can sometimes be justified if the manager is deemed to be prudent at evaluating credit risk in their past careers and to have set up well-resourced and effective operations.

Idiosyncratic risk profile: The degree of collateral granularity is an important determinant for explaining idiosyncratic risk. Granularity can vary greatly dependent on the structured credit sector, an example being European CMBS collateral which can be against a single property, whereas a BSL CLO will be typically backed by 150-250 corporate obligors across a diverse industry set. In the case for CLOs, the highly granular pools allow diversification against obligor specific idiosyncratic risk, and to an extent, sectoral specific risk. However, the argument made around diversification should not induce complacency to the risks brought on by poor active management by CLO managers. Key to this is evaluating the underlying credit fundamentals. With this, there is a variety of market standard metrics at hand such as the market value of overcollateralization (MVOC); weighted average rating factor (WARF); diversity scores; CCC rated asset exposure; loans priced below 80, to name just a few. Whilst these metrics prove useful on headline characteristics, more granular observations are required to comprehensively evaluate credit risk, especially around the tail risk of the CLO portfolio. Such evaluation is often intertemporal in nature; critical is observing a manager’s behaviour and active management over time, including their ability to identify credit risk of obligors before sustained pain is realized.

Beside the fundamentals on the underlying collateral pool, other idiosyncrasies can arise from the structural nuances of a particular deal. In general, CLOs have a fairly standard legal framework but there are variations which need to be considered. An example of a variation can be when certain managers command greater leniency around the ‘guardrails’ on the collateral concentration limitation language. Furthermore, there can be a change in the dynamics of whether CLOs are structurally more debt- or equity-friendly over time, which is something to be mindful of when considering investment across the spectrum of managers and different vintage CLOs.

Another critical element when considering idiosyncratic risk involves evaluating the issuer, with priority given to their underwriting process and their ability to properly assess credit risk of the underlying collateral on an ongoing basis. Other considerations are the sustainability of their business model, funding model, senior leadership changes and ESG integration. Prytania regularly engages new issuers through our wide network and continues to monitor performance of those we are actively invested in. Specifically, for CLO managers, we have built customised tools that track their investment behavior and the underlying credit composition.

Important Disclaimer

This document has been prepared for discussion purposes only by Prytania Asset Management and its subsidiary, Prytania Investment Advisors LLP (“Prytania”), a limited liability partnership (OC305343) incorporated in the UK and regulated by the Financial Conduct Authority (FCA). Prytania is registered as an Investment Advisor with the US Securities and Exchange Commission.

This discussion document is not meant for distribution in any other jurisdiction or to anyone else and is not an offer to purchase any product or service rendered by Prytania. Such services may only be offered subject to a discretionary investment management agreement a standard draft copy of which inclusive of the full risk disclosure in respect of derivative instruments is available from Prytania.

This document does not constitute as an offer or solicitation in any state or other jurisdiction to subscribe for or purchase any securities. Neither the US Securities and Exchange Commission or any state securities authority or self-regulatory organization has reviewed or passed upon the accuracy or adequacy of this document or merits of the matters described in it. Any statement to the contrary is unlawful.

No offer or sale is made via this document. Offers and/or sales are only made via the confidential private placement memorandum ("PPM"), and other related documentation to investors meeting stringent qualification standards as outlined in the PPM.

The information in this document is confidential and remains the property of Prytania. It is being shared solely for the confidential use of the recipient. Any offering or potential transaction that may be related to the subject matter of this presentation will be made by separate and distinct documentation and in such case the information contained herein will be superseded in its entirety by such documentation in its final form. Further, any such offering will be at your request and will be subject to negotiation between us. Any terms and conditions of any offering or transaction discussed herein are subject to change without notice.

In addition, because this document is a summary only, it may not contain all material terms, this document, in and of itself should not form the basis for any investment decision.

Any legends, disclaimers or other notices that may appear below or on any electronic communication to which this presentation is attached which state that (1) these materials do not constitute an offer (or a solicitation of an offer) or (2) no representation is made as to the accuracy or completeness of these materials and that these materials may not be updated are not applicable to this communication and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this communication having been sent via e-mail or another system.

There are significant risks associated with investment in the Funds discussed herein. Investment in these unregulated schemes is intended for sophisticated investors who can accept the risks associated with such an investment including a substantial or complete loss of their investment. Such schemes are permitted to use gearing as an investment strategy. The effect is that movements in the price of the schemes may be more volatile than the movements in the prices of their underlying investments. The value of investments can go down as well as up and the value of the investor’s investment may be extremely volatile and subject to sudden and substantial falls. Certain investment positions may be illiquid, income from investments may fluctuate and changes in rates of exchange may have an adverse effect on the value, price or income of investments. The foregoing list of risk factors is not complete, and reference should be made to the relevant prospectus. Furthermore, past performance is not necessarily indicative of future results, and nothing contained herein shall constitute any representation or warranty as to future performance of any financial instrument, credit, currency, rate or other market or economic measure. Each prospective investor should make his or her own investigations and evaluations of the information contained herein and in the offering materials and should consult his or her attorney, financial and tax advisor before investing.

Comments